by Patrick Hoza, US Tax & Financial Services

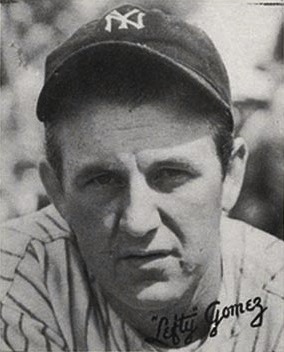

Lefty Gomez, an all-star pitcher for the New York Yankees in the 1930's, is credited with saying "I'd rather be lucky than good." He is also credited with earning the nicknames "Goofy Gomez," and "El Goofo." Still, I often think Lefty had it right and today could very well be your lucky day.

Lefty Gomez, an all-star pitcher for the New York Yankees in the 1930's, is credited with saying "I'd rather be lucky than good." He is also credited with earning the nicknames "Goofy Gomez," and "El Goofo." Still, I often think Lefty had it right and today could very well be your lucky day.

If you are a US citizen and want to give up your citizenship but have fretted over unfiled returns or the fact you do not have a US social security number, then the IRS has a procedure for you! It’s called ‘Relief Procedures for Certain Former Citizens’.

This procedure allows an individual that meets the following eligibility requirements to have a “get out of jail free” card.

- Your past compliance failures were due to non-wilful conduct.

- You have relinquished your U.S. citizenship after March 18, 2010.

- You have no filing history as a U.S. citizen or resident.

- You did not exceed the threshold in Internal Revenue Code Section 877(a)(2)(A), relating to average annual net income tax for the period of 5 tax years ending before your date of expatriation. This amount is $171,000 for 2020 and is indexed for inflation each year.

- Your net worth is less than $2,000,000 at the time of expatriation and at the time of making your submission under these procedures.

- You have an aggregate total tax liability of $25,000 or less for the five tax years preceding expatriation and in the year of expatriation.

- You agree to complete and submit with your submission all required Federal tax returns for the six tax years at issue, including all required schedules and information returns.

Assuming you qualify and follow this procedure, you will not owe any taxes due per the filed return, a savings of up to $25,000.

It does not get much better than that. As well, if you do not have a US social security number, you are not required to obtain one under these procedures.

So, we hope that this is a lucky day for some of you out there; we are happy to guide you through this procedure.

Author bio

Since 1990, Patrick Hoza has many years of experience with US individual expatriate taxation under his belt, including High Net Worth Individuals, streamline/voluntary disclosure filings and tax consulting, as well as working with large multinationals like Novartis, BP, Hewlett Packard and General Electric. He has extensive knowledge in serving both US expatriates and resident and non-resident aliens with their US tax-related issues. Patrick Hoza is a Tax Director at US Tax & Financial Services, with extensive experience in all aspects of Individual US tax and Expatriation, including Hight Net Worth Individuals and large multinationals.

Since 1990, Patrick Hoza has many years of experience with US individual expatriate taxation under his belt, including High Net Worth Individuals, streamline/voluntary disclosure filings and tax consulting, as well as working with large multinationals like Novartis, BP, Hewlett Packard and General Electric. He has extensive knowledge in serving both US expatriates and resident and non-resident aliens with their US tax-related issues. Patrick Hoza is a Tax Director at US Tax & Financial Services, with extensive experience in all aspects of Individual US tax and Expatriation, including Hight Net Worth Individuals and large multinationals.

Patrick started his career in 1990 in California, with Westpro Ltd., as a Senior Tax Consultant, then spent the middle part of his career working at KPMG and Ernst & Young. During his time with Ernst & Young, he worked and lived in Russia, France and finally Switzerland. He has gained a valuable working knowledge of the respective income tax regulations in all of these countries.

Patrick holds a B.A. in International Relations from the University of Colorado, is a member of the National Association of Enrolled Agents and is a Certified Acceptance Agent.