Fund Advisers publishes useful offshore investment guide

The Geneva-based wealth management company, Fund Advisers, has published the first in a series of offshore investment guides for clients.

With many customers now demanding clear, independent advice on this increasingly complex subject, Fund Advisers has chosen the EU Savings Directive as the theme for the first of its guides. With the aim of helping investors retain their privacy, protect their assets, and secure their ongoing financial development, the new 12-page guide provides detailed information on this recently amended directive and presents a number of ideas about how to invest efficiently “within the spirit” of it.

The European Savings Tax Directive (ESD) is one of three measures relating to tax, which together are known as the EU Tax Package. The ESD is an agreement between the Member States of the European Union (EU) to automatically exchange information with each other about customers who earn savings income in one EU Member State but reside in another (the automatic exchange of information option). The aim of the ESD is to ensure that citizens of one member state do not evade taxation by depositing funds outside the jurisdiction of residence and so distort the single market.

All Member States of the European Union are subject to the ESD. The EU hoped that non-member states, particularly those that are considered tax havens, would also sign up to the principles, if not the details, of the ESD.

Under the ESD, there are 4 main categories of "savings income": Bank account and fixed rate deposits; Interest paid on the closure of a bank account; Distributions from certain investment funds; Income accumulated and paid out upon sale or redemption of units in certain investment funds.

If you do not want tax to be withheld on your behalf, you have the right to expressly authorise the bank or investment house (the paying agent) to pass on your information to your EU Member State. If you believe you are exempt from withholding tax, you can prevent withholding tax being levied against your assets upon presentation of relevant documentation from your EU Member State showing that you are tax exempt.

A number of EU Member States have decided against the automatic exchange of information option, and decided to apply a ‘withholding tax option’ for a given transitional period. Under the withholding tax option, banks and other paying agents automatically deduct tax from interest and other savings income earned and pass it to their local tax authority, indicating how much of the total amount relates to customers in each Member State.

Individuals who are resident in an EU Member State are affected by the ESD. From 1st July, 2011 all residents of these countries, whether domiciled or not, have been made subject to this exchange of information.

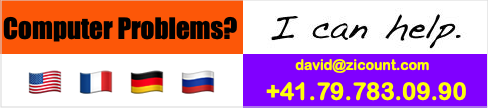

Fund Advisers Director, David Cooper, told knowitall.ch, “When it comes to tax planning, the earlier you start thinking about it the better. You can evaluate your options, quantify your tax liabilities, plan your investment strategy, decide on ownership structures and take steps to avoid tax—legally. Expert professional advice is essential and you should seek an independent financial adviser or tax expert who is knowledgeable about EU tax rules.”

To receive a copy of this useful, independent guide, just complete the form at the following link: http://offshoreinvestmentguide.eu/eu-savings-tax-directive. Once you have registered for the guide you will receive an email containing a link to the new guide.

Fund Advisers Europe

022 347 0052

www.fundadvisers.eu

Link to brochure: http://offshoreinvestmentguide.eu/eu-savings-tax-directive